Is There Property Tax In Missouri . Find out how property tax rates vary by county and. the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or. Obtaining a property tax receipt or waiver. for 2022, we received supporting data on 4,854 property tax rates of 2,809taxing authorities. learn who owes, how much, and when to pay property tax in missouri. Income tax, sales tax and other taxes. That comes in lower than the national average by a good margin, which currently stands at. The average effective property tax rate in missouri is 0.96%, but this can vary quite. This is the eighth year since. find out how to calculate property tax rates for 2024 or 2023 in missouri using the state auditor's online tools. the average effective property tax rate in missouri is 0.88%. property taxes in missouri.

from www.ksdk.com

Income tax, sales tax and other taxes. find out how to calculate property tax rates for 2024 or 2023 in missouri using the state auditor's online tools. the average effective property tax rate in missouri is 0.88%. Find out how property tax rates vary by county and. That comes in lower than the national average by a good margin, which currently stands at. learn who owes, how much, and when to pay property tax in missouri. The average effective property tax rate in missouri is 0.96%, but this can vary quite. for 2022, we received supporting data on 4,854 property tax rates of 2,809taxing authorities. This is the eighth year since. property taxes in missouri.

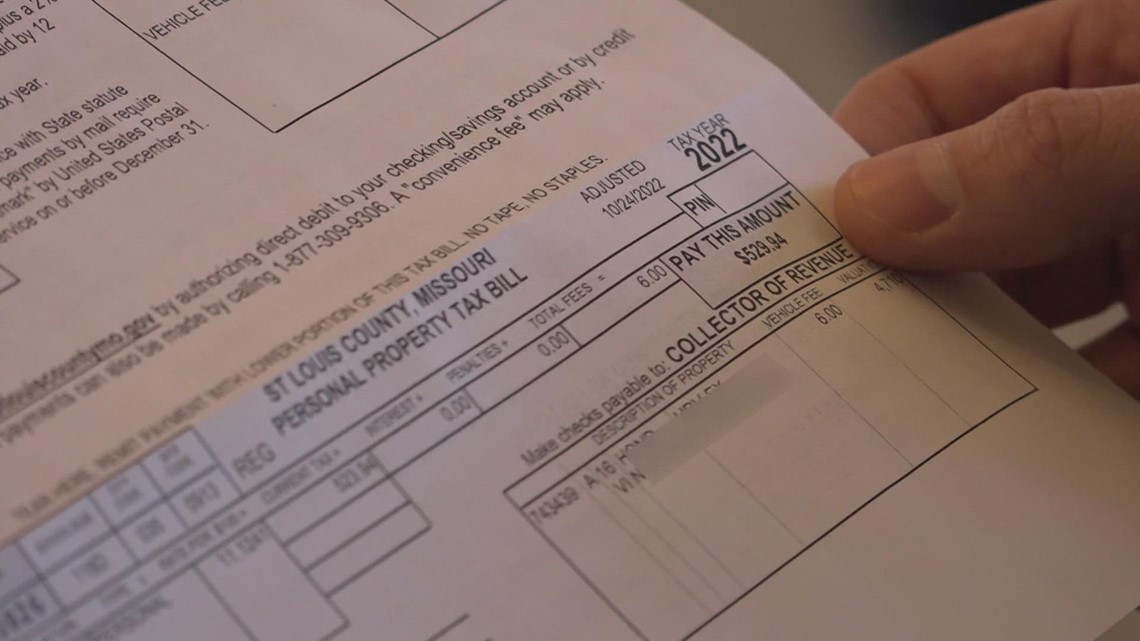

Missouri personal property tax bills increase by 30

Is There Property Tax In Missouri find out how to calculate property tax rates for 2024 or 2023 in missouri using the state auditor's online tools. The average effective property tax rate in missouri is 0.96%, but this can vary quite. the average effective property tax rate in missouri is 0.88%. This is the eighth year since. find out how to calculate property tax rates for 2024 or 2023 in missouri using the state auditor's online tools. for 2022, we received supporting data on 4,854 property tax rates of 2,809taxing authorities. That comes in lower than the national average by a good margin, which currently stands at. property taxes in missouri. Income tax, sales tax and other taxes. learn who owes, how much, and when to pay property tax in missouri. the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or. Obtaining a property tax receipt or waiver. Find out how property tax rates vary by county and.

From www.pinterest.com

Missouri Property Taxes By County 2018 Property tax, Missouri, Tax Is There Property Tax In Missouri for 2022, we received supporting data on 4,854 property tax rates of 2,809taxing authorities. This is the eighth year since. Income tax, sales tax and other taxes. the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or. Obtaining a property tax receipt. Is There Property Tax In Missouri.

From www.steadily.com

Missouri Property Taxes Is There Property Tax In Missouri Obtaining a property tax receipt or waiver. This is the eighth year since. for 2022, we received supporting data on 4,854 property tax rates of 2,809taxing authorities. the average effective property tax rate in missouri is 0.88%. Income tax, sales tax and other taxes. The average effective property tax rate in missouri is 0.96%, but this can vary. Is There Property Tax In Missouri.

From taxedright.com

Missouri State Taxes Taxed Right Is There Property Tax In Missouri for 2022, we received supporting data on 4,854 property tax rates of 2,809taxing authorities. property taxes in missouri. learn who owes, how much, and when to pay property tax in missouri. Obtaining a property tax receipt or waiver. find out how to calculate property tax rates for 2024 or 2023 in missouri using the state auditor's. Is There Property Tax In Missouri.

From www.templateroller.com

2021 Missouri Tax Chart Fill Out, Sign Online and Download PDF Templateroller Is There Property Tax In Missouri find out how to calculate property tax rates for 2024 or 2023 in missouri using the state auditor's online tools. The average effective property tax rate in missouri is 0.96%, but this can vary quite. learn who owes, how much, and when to pay property tax in missouri. That comes in lower than the national average by a. Is There Property Tax In Missouri.

From missouricitycashhousebuyers.com

Property Taxes Missouri City Cash House Buyers Is There Property Tax In Missouri the average effective property tax rate in missouri is 0.88%. Income tax, sales tax and other taxes. the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or. Obtaining a property tax receipt or waiver. This is the eighth year since. Find out. Is There Property Tax In Missouri.

From exobjyvlx.blob.core.windows.net

Saint Charles Missouri Personal Property Tax at Milly Hicks blog Is There Property Tax In Missouri Find out how property tax rates vary by county and. find out how to calculate property tax rates for 2024 or 2023 in missouri using the state auditor's online tools. The average effective property tax rate in missouri is 0.96%, but this can vary quite. Income tax, sales tax and other taxes. property taxes in missouri. for. Is There Property Tax In Missouri.

From www.dochub.com

Missouri property tax credit form Fill out & sign online DocHub Is There Property Tax In Missouri learn who owes, how much, and when to pay property tax in missouri. Find out how property tax rates vary by county and. find out how to calculate property tax rates for 2024 or 2023 in missouri using the state auditor's online tools. The average effective property tax rate in missouri is 0.96%, but this can vary quite.. Is There Property Tax In Missouri.

From www.formsbank.com

Fillable Form MoPts Property Tax Credit 2008 printable pdf download Is There Property Tax In Missouri Obtaining a property tax receipt or waiver. the average effective property tax rate in missouri is 0.88%. for 2022, we received supporting data on 4,854 property tax rates of 2,809taxing authorities. Find out how property tax rates vary by county and. That comes in lower than the national average by a good margin, which currently stands at. This. Is There Property Tax In Missouri.

From cerpnzxr.blob.core.windows.net

How Much Is Missouri Personal Property Tax at Christopher Devries blog Is There Property Tax In Missouri Find out how property tax rates vary by county and. learn who owes, how much, and when to pay property tax in missouri. Income tax, sales tax and other taxes. The average effective property tax rate in missouri is 0.96%, but this can vary quite. for 2022, we received supporting data on 4,854 property tax rates of 2,809taxing. Is There Property Tax In Missouri.

From www.formsbank.com

Fillable Form MoPts Property Tax Credit 2013 printable pdf download Is There Property Tax In Missouri Obtaining a property tax receipt or waiver. That comes in lower than the national average by a good margin, which currently stands at. The average effective property tax rate in missouri is 0.96%, but this can vary quite. the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of. Is There Property Tax In Missouri.

From dxokvwiuo.blob.core.windows.net

Missouri City Property Tax Calculator at Juan Palmer blog Is There Property Tax In Missouri the average effective property tax rate in missouri is 0.88%. learn who owes, how much, and when to pay property tax in missouri. the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or. This is the eighth year since. for. Is There Property Tax In Missouri.

From prorfety.blogspot.com

Missouri Property Tax Assessment Rates PRORFETY Is There Property Tax In Missouri learn who owes, how much, and when to pay property tax in missouri. the average effective property tax rate in missouri is 0.88%. Obtaining a property tax receipt or waiver. That comes in lower than the national average by a good margin, which currently stands at. find out how to calculate property tax rates for 2024 or. Is There Property Tax In Missouri.

From www.templateroller.com

Form MOPTC 2022 Fill Out, Sign Online and Download Printable PDF, Missouri Templateroller Is There Property Tax In Missouri the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or. learn who owes, how much, and when to pay property tax in missouri. This is the eighth year since. the average effective property tax rate in missouri is 0.88%. Obtaining a. Is There Property Tax In Missouri.

From southarkansassun.com

Property Tax In Missouri Now Allows Eligible Senior Homeowners To Freeze Their Property Tax Is There Property Tax In Missouri This is the eighth year since. the average effective property tax rate in missouri is 0.88%. property taxes in missouri. Find out how property tax rates vary by county and. The average effective property tax rate in missouri is 0.96%, but this can vary quite. learn who owes, how much, and when to pay property tax in. Is There Property Tax In Missouri.

From www.taxuni.com

Missouri Personal Property Taxes Is There Property Tax In Missouri This is the eighth year since. property taxes in missouri. The average effective property tax rate in missouri is 0.96%, but this can vary quite. the average effective property tax rate in missouri is 0.88%. learn who owes, how much, and when to pay property tax in missouri. find out how to calculate property tax rates. Is There Property Tax In Missouri.

From www.templateroller.com

Form MOPTC 2022 Fill Out, Sign Online and Download Printable PDF, Missouri Templateroller Is There Property Tax In Missouri Find out how property tax rates vary by county and. property taxes in missouri. find out how to calculate property tax rates for 2024 or 2023 in missouri using the state auditor's online tools. learn who owes, how much, and when to pay property tax in missouri. Income tax, sales tax and other taxes. That comes in. Is There Property Tax In Missouri.

From 101theeagle.com

New Missouri Law Gives Seniors Relief from Property Tax Hikes Is There Property Tax In Missouri for 2022, we received supporting data on 4,854 property tax rates of 2,809taxing authorities. This is the eighth year since. property taxes in missouri. the average effective property tax rate in missouri is 0.88%. That comes in lower than the national average by a good margin, which currently stands at. learn who owes, how much, and. Is There Property Tax In Missouri.

From www.formsbank.com

Form Mo1040p Missouri Individual Tax Return And Property Tax Credit Claim/pension Is There Property Tax In Missouri learn who owes, how much, and when to pay property tax in missouri. Obtaining a property tax receipt or waiver. the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or. Income tax, sales tax and other taxes. The average effective property tax. Is There Property Tax In Missouri.